2026 Credit Union Security Mandate: From Compliance to Cyber Resilience

For Credit Unions, the mission has always been “people helping people.” In 2025 and leading into 2026, fulfilling that mission requires more than just financial stewardship—it demands digital fortitude.

Embedded within this week’s blog post published by Coeus Consulting, we discuss the challenge and strategies to reduce #risk, #cost, and complexity when dealing with the ever-changing global #threat landscape.

2026: Global threat landscape evolving, growing, and becoming more elusive

As the financial sector faces a 1,265% increase in AI-driven phishing attacks and tightening NCUA scrutiny, the gap between “compliant” and “secure” has never been wider.

Read more in our Guide to Defending Against Adversarial AI

This year isn’t just about checking boxes; it’s about leveraging technical controls to protect member trust and ensuring your institution’s longevity.

Compliance Mandates for Credit Unions

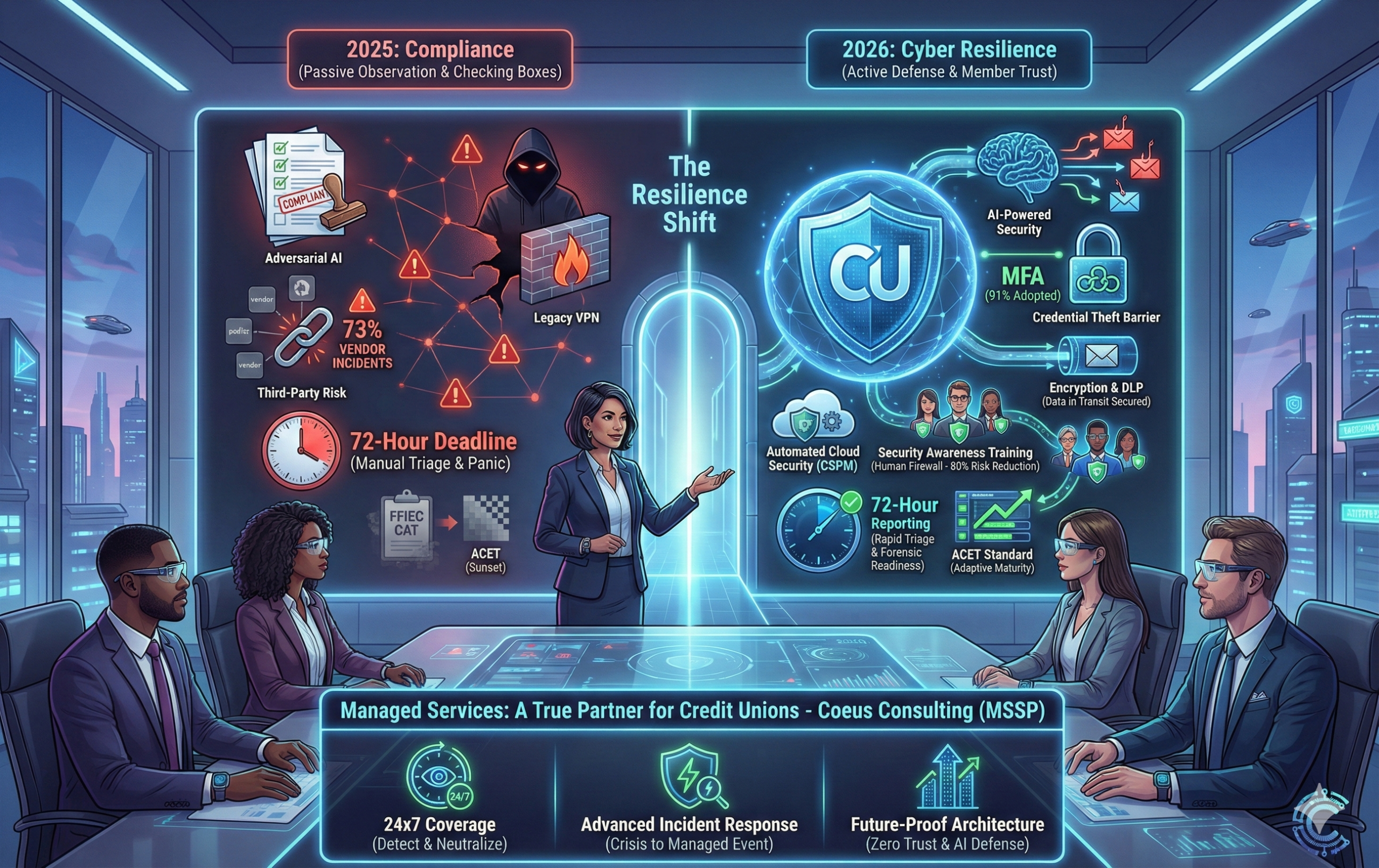

The regulatory landscape for 2025 has shifted from passive observation to active defense. The National Credit Union Administration (NCUA) has made it clear: cybersecurity is a safety and soundness issue.

● The 72-Hour Reporting Rule: The most critical operational change is the strict enforcement of the cyber incident notification rule. Credit Unions must now report substantial cyber incidents to the NCUA within 72 hours. This demands not just detection, but rapid triage and forensic capability that many internal IT teams lack.

● Third-Party Risk Management (TPRM): With 73% of reported incidents in the sector originating from third-party vendors, the NCUA is heavily scrutinizing supply chains. Examiners are no longer satisfied with a simple vendor list; they require proof of continuous monitoring and rigorous due diligence of your digital partners.

● The ACET Standard: As the FFIEC Cybersecurity Assessment Tool sunsets, the Automated Cybersecurity Evaluation Toolbox (ACET) is becoming the de facto standard for maturity assessments. The focus is moving toward “Adaptive” maturity levels, requiring Credit Unions to demonstrate they can dynamically respond to threats, not just document them.

What cybersecurity controls are required?

To meet these mandates, credit unions must deploy a defense-in-depth strategy.

Download the managing through employee risk blog here

Here are the non-negotiables and the business value they deliver:

● Encryption & VPNs: Data in transit must be unreadable to interceptors. While VPNs are standard, they are also a target—56% of organizations experienced a VPN-exploited breach last year.

○ Business Value: protects member PII during remote work and prevents regulatory fines associated with data interception.

● Multi-Factor Authentication (MFA): With 91% of financial institutions adopting MFA for remote access by 2025, it is the single most effective barrier against credential theft.

○ Business Value: drastically reduces the risk of account takeovers, which costs the industry millions annually in fraud losses.

● AI-Powered Email Security: Traditional filters are failing against Generative AI phishing. Advanced AI email security analyzes communication patterns to stop sophisticated Business Email Compromise (BEC) attacks.

○ Business Value: Stops the #1 entry point for ransomware, preventing operational paralysis that costs an average of $4.45 million per breach.

● Data Loss Prevention (DLP): DLP tools classify and block sensitive data (SSNs, account numbers) from leaving your network via email or USB.

○ Business Value: Acts as a final safety net against accidental insider error—which accounts for nearly 68% of data breaches.

● Application & Cloud Security: As Credit Unions migrate to the cloud, “misconfiguration” remains a top risk. Automated cloud security posture management (CSPM) is essential.

○ Business Value: Enables rapid digital transformation and mobile banking features without exposing the core banking system to the public internet.

● Security Awareness Training: Your staff is your human firewall. Consistent phishing attack simulation training can reduce susceptibility to attacks by up to 80%.

○ Business Value: Transforms employees from your most significant risk into your first line of defense, protecting the credit union’s reputation

Managed Services: A True Partner for Credit Unions

The complexity of maintaining this security stack 24/7 is often beyond the reach of internal IT teams. This is where a Managed Security Service Provider (MSSP) becomes more than a vendor; it becomes a strategic partner.

Coeus Consulting stands out with a distinct commitment to the credit union marketplace. They understand that for a credit union, IT failure isn’t just an inconvenience—it’s a breach of member trust.

● 24×7 Coverage: Cyber threats don’t sleep, and neither should your defense. Coeus provides round-the-clock monitoring, ensuring that suspicious activity is detected and neutralized at 3 AM on a Sunday, not 9 AM on a Monday.

● Advanced Incident Response: When seconds count, Coeus offers the forensic expertise required to meet the NCUA’s 72-hour reporting window, turning a potential crisis into a managed event.

● Future-Proof Architecture: By staying ahead of trends like Zero Trust and AI defense, Coeus ensures your security architecture is an asset that enables new member services, rather than a legacy anchor holding you back.

● Compliance Reporting: Coeus simplifies the exam process by providing the exact reports and documentation examiners look for, turning compliance from a headache into a routine assurance.

Credit unions looking to improve their compliance monitoring and reporting lean into MSSPs’ like Coeus Consulting by leveraging their add-on compliance advisory services.

Access the compliance advisory services page here

In an era where trust is the currency of the realm, partnering with Coeus Consulting ensures your Credit Union remains resilient, compliant, and focused on what matters most: your members.

Let’s discuss your compliance, cybersecurity, cloud, and IT management needs today!

#CreditUnionSecurity #NCUACompliance #CyberResilience #MSSP #CoeusConsulting #72HourRule #TPRM #VendorRiskManagement #ACET #CybersecurityAssessment #FinancialServicesIT #ZeroTrust #PhishingProtection #RansomwareDefense #MFA #BusinessEmailCompromise #DataLossPrevention #CloudSecurity #ManagedITServices #PhoenixIT #CreditUnionIT #RegulatoryCompliance #CyberThreats2026 #IncidentResponse #EmployeeSecurityTraining